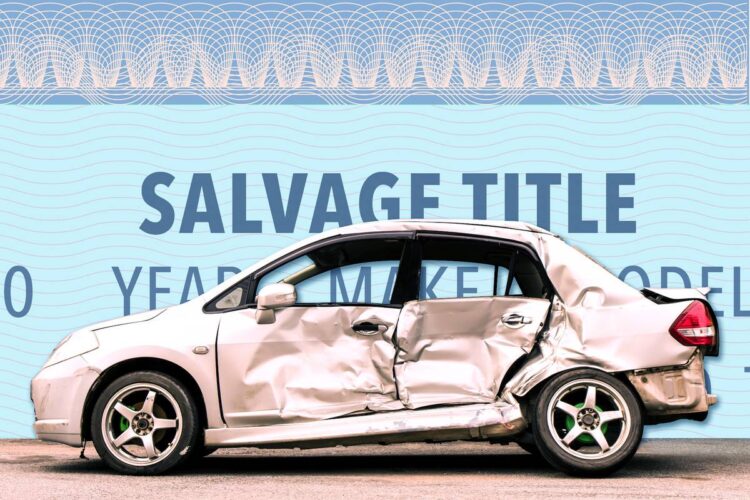

Acquiring a new vehicle is also a considerable financial investment and, for some, it may be their most consequential financial decision. Due to the cost of new cars, some consumers are finding extended value in private or dealership used car sales. However, this investment also presents unique purchasing challenges, particularly when the buyer finds a vehicle with a salvaged title.

If you’ve come across a potential used car buyer and it is salvage title, you may be wondering if you should take the leap to make the purchase. This article will cover the key components of understanding when looking at a vehicle with a salvaged title, including what you would want to be aware of before making the purchase.

What is salvaged tile?

A salvaged title indicates a vehicle that an insurance company has determined to be a total loss. Typically, the vehicle is seen as a total loss when the cost of repairing the vehicle from an accident, flood, theft recovery, or any damaging circumstance exceeds around 75-80% of the vehicle’s value at that time. When obtaining a salvage title, this particular vehicle was determined to be a vehicle repairable for less than its resale value or repairable at all by the insurance company. Most salvaged title vehicles are sold at a total loss auction to repair shops or individuals willing to restore the vehicle to a drivable condition.

If you are going to potentially purchase a written off vehicle it is important to obtain a salvage check. This report provides insight into the vehicle’s history that may not be made available to you from the seller. The history can indicate collisions, prior repairs, and any structural damage the vehicle may have incurred during its life cycle. If you become more educated on the vehicle history you can determine its overall value at the time of purchase.

Benefits of Purchasing a Vehicle with a Salvaged Title

While purchasing a car with a salvaged title is often less favorable than purchasing a car with a clean title, there are some benefits to be aware of.

A major reason to consider a car with a salvaged title is the significant cost savings. In general, you can purchase a salvaged vehicle for much less than a car with a clean title, possibly 20% to almost 50% less. This lower price point may often mean a better chance you can get a higher trim level or model if you have a limited budget. For a person who likes to work on cars or has a qualified and trusted mechanic looking at the vehicle for you, this can be a way to own a vehicle for a lower price.

Another benefit is that it offers the opportunity to restore and customize it to your showing standards. Some car enthusiasts may enjoy the project of restoring or customizing a salvaged vehicle. If you have the knowledge and capabilities, it can be fun and rewarding to have a vehicle you brought back to life just to turn around and make it your own… potentially making a car that is worth more money than you invested in it. This type of vehicle could also be extremely useful for someone who needs a second car and only needs it from time to time, for example a work vehicle or a short commute second car.

The Drawbacks of Buying a Vehicle with a Salvage Title

If you think the price advantage is worth the risk, there are many reasons not to consider a car with a salvage title. First, as with any car, these risks are of particular importance when considering safety. While the car could have been basically repaired, bear in mind that a car may not be as safe in an accident as before the accident, in particular, a car that hit something head-on.

It’s possible that a salvaged title car does not have the same structural integrity of the original vehicle and probably was not initially safe to drive before the accident. That all said, have a qualified mechanic examine the automobile carefully, particularly for structural integrity and if repairs are “kosher” or acceptable. These are safety concerns one would absolutely want to be sure of before hitting the gas pedal.

Secondly, it’s likely that a salvage-titled car will be difficult to insure and/or finance. Many insurance companies will not insure you or will only give you liability insurance because they are unsure of the total history of repairs to the vehicle. It is possible you will get an insurance company willing to insure the salvaged vehicle with limits such as only liability insurance. Likewise, as if no one wants to offer insurance, banks, credit unions, and lending institutions are also likely to offer you a loan on the vehicle or provide financing to buy the car at all.