Getting around the financial market can be daunting for new investors. With proper strategies, patience, and knowledge of economic trends, you can make informed decisions that lead to steady growth and minimized risks. Below are ways to help you maximize opportunities and avoid common pitfalls.

Table of Contents

Key Points:

- Begin with clear goals for your investments.

- Understand risk and diversify your portfolio.

- Use tools to analyze stocks and evaluate opportunities.

- Monitor macroeconomic indicators to guide decisions.

- Focus on long-term value over short-term gains.

Set Clear Investment Goals

Every journey begins with clarity. Start by determining what you aim to achieve through your investments. Is it to build wealth over decades, generate regular income, or secure your retirement? Goals shape your strategies and the type of assets you pursue.

For those focused on generating consistent income, looking into assets that provide reliable returns is key. Many investors research highest dividend yield stocks at the start of their planning phase.

Learn to Evaluate Market Opportunities

Assessing market opportunities requires effort and the right tools. Start by analyzing companies with strong fundamentals. Study their balance sheets, revenue growth, and profitability. Avoid decisions based on hype or fleeting trends.

Tips for Effective Evaluation:

- Review historical price trends and earnings reports.

- Compare industry performance to gauge stability.

- Understand the impact of external factors like interest rates and inflation.

A company with a consistent payout history often indicates financial strength. Use these insights to filter quality options.

Monitor Economic Indicators

Economic trends heavily influence investment outcomes. Rising interest rates, for instance, can dampen equity growth but may enhance income-generating opportunities like bonds. Stay informed by tracking GDP data, inflation rates, and central bank policies.

Why Indicators Matter:

- Interest rates: Affect borrowing costs for businesses.

- Inflation: Influences purchasing power and corporate profitability.

- GDP trends: Signal overall economic health and growth potential.

Studying these factors helps predict market shifts and align strategies accordingly.

Diversify to Reduce Risk

Relying on one asset or sector exposes your portfolio to unnecessary risks. Diversification spreads investments across various sectors, asset types, and regions, balancing potential losses with gains.

How to Diversify:

- Allocate funds to equities, bonds, and other instruments.

- Explore markets outside your home country for added balance.

- Consider low-risk options alongside high-yield investments.

For example, pairing technology equities with defensive sectors such as utilities creates a hedge during market downturns.

Focus on Consistency Over Hype

Chasing high returns can lead to disappointment. Focus on investments with steady growth potential instead of risky ventures that promise quick rewards. Long-term growth often outperforms short-term speculation.

Some industries, like consumer staples or healthcare, offer stability and dependable payouts even during economic downturns. Keep emotions out of decisions to maintain discipline.

Adopt Risk Management Practices

Risk is inherent in every investment, but smart management can protect your capital. Never invest more than you can afford to lose. Employ stop-loss orders and regularly rebalance your portfolio to adapt to changing market conditions.

Steps for Managing Risk:

- Set clear entry and exit points for each asset.

- Limit exposure to volatile sectors or underperforming assets.

- Regularly review holdings to align with your goals.

Risk mitigation ensures that market fluctuations don’t derail your progress.

Leverage Tools and Technology

Investors today have access to sophisticated tools for analysis and forecasting. Platforms offering real-time data, stock screeners, and financial reports empower you to make informed choices. Automation can also streamline processes like portfolio tracking.

Popular Tools:

- Fundamental analysis platforms.

- Economic calendar apps for tracking key events.

- Charting tools for technical insights.

Incorporating technology enhances accuracy and efficiency in your decision-making.

Stay Educated on Market Trends

The financial landscape is always evolving. Regular learning helps you stay ahead. Follow trusted sources, attend webinars, and read reports on emerging industries or economic changes. Knowledge equips you to adapt strategies when needed.

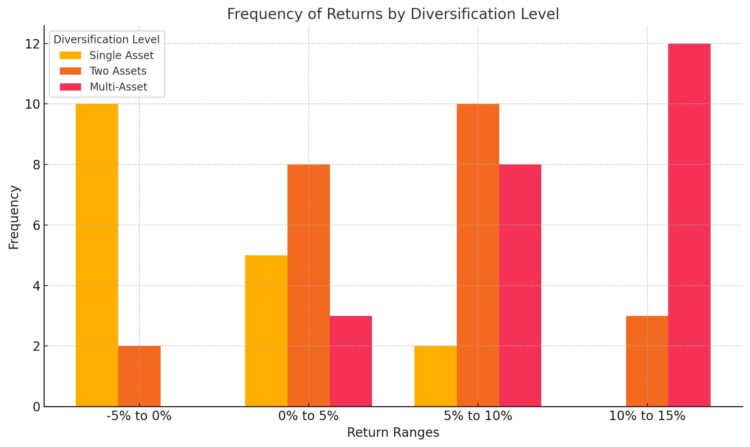

Histogram: Frequency of Returns by Diversification Level

This histogram shows the frequency of returns across different diversification levels. It highlights how portfolios with higher diversification (multi-asset) tend to achieve higher return ranges more frequently compared to portfolios with lower diversification, reducing the likelihood of significant losses.

Develop a Strong Exit Strategy

Entering the market is only half the equation; knowing when to exit is equally critical. An exit strategy ensures you secure profits or limit losses by selling at the right time. Without a plan, emotional decision-making often takes over, leading to poor outcomes.

Define clear exit points for every investment, whether based on price targets or timeframes. Use tools like stop-loss orders to automatically trigger sales if prices fall below a certain threshold. This approach protects your capital and maintains discipline, ensuring you stick to your financial objectives.

Invest in Sectors Aligned with Economic Trends

Certain sectors perform better depending on the prevailing economic climate. During periods of low interest rates, technology and growth-oriented companies tend to thrive. Conversely, high-interest-rate environments often favor energy, commodities, and defensive sectors like utilities.

Study how macroeconomic changes affect sector performance and adjust your portfolio accordingly. For example, if inflation rises, companies with pricing power, like those in the consumer goods sector, may become more attractive. Matching your investments to current trends maximizes returns while minimizing exposure to lagging industries.

Build a Network of Like-Minded Investors

Surrounding yourself with experienced investors can provide valuable insights. Communities of traders, both online and offline, offer a wealth of shared knowledge. Engaging with others helps you learn about market movements, new opportunities, and strategies that work in different scenarios.

Join forums, attend workshops, or participate in local investor meetups. Regular discussions with like-minded individuals can also keep you motivated and accountable. Beyond the exchange of ideas, these connections often lead to collaborations or mentorship opportunities that accelerate your growth as an investor.

Seek Professional Guidance

If the complexity becomes overwhelming, consider consulting a financial advisor. Professionals provide insights tailored to your goals, risk tolerance, and market conditions. Their expertise can prevent costly errors and optimize outcomes.

Conclusion

Successful investing requires clarity, discipline, and a focus on fundamentals. Set clear goals, use tools to analyze opportunities, and monitor economic trends to guide decisions. Diversification and risk management protect your progress, while ongoing education ensures you adapt to market changes. With the right approach, you can maximize your opportunities and achieve lasting growth.